E-Waste : Calculation for Required No. of Recycled Metal Wise EPR Certificates

In this article we shall explain the method to calculate the EPR targets for E-Waste generators for each recoverable key metal under E-Waste Management Rules,2022.

1. Key Features of the notification:

• The Central Pollution Control Board (CPCB) issued a notification on September 21, 2023, introducing the framework for generation of EPR certificates for key metals recycled from various EEE (Electrical and Electronic) items included in Schedule-I under the E-Waste (Management) Rules, 2022.

• The key metals covered under the notification are:

a) Gold (Au)

b) Non-ferrous metals – Aluminum (Al) and Copper (Cu)

c) Iron – including steel and galvanized iron

• For the initial 2yrs, the EPR certificate generation is only limited to precious metals (Cu, Au, Fe & Al). Rare earth and other precious metals will also be considered under this EPR regime after some time.

• The weights of the key recoverable metals from various EEE items (as % of the weight of the EEE item) are listed in Annexure-I of the said notification of CPCB, available at – CLICK HERE

2. Case Study- For EPR certificate generation

• Let’s take the case of a company ‘ABC’ which produces and sells six different kinds of products (IT and Non-IT products) in the Indian market

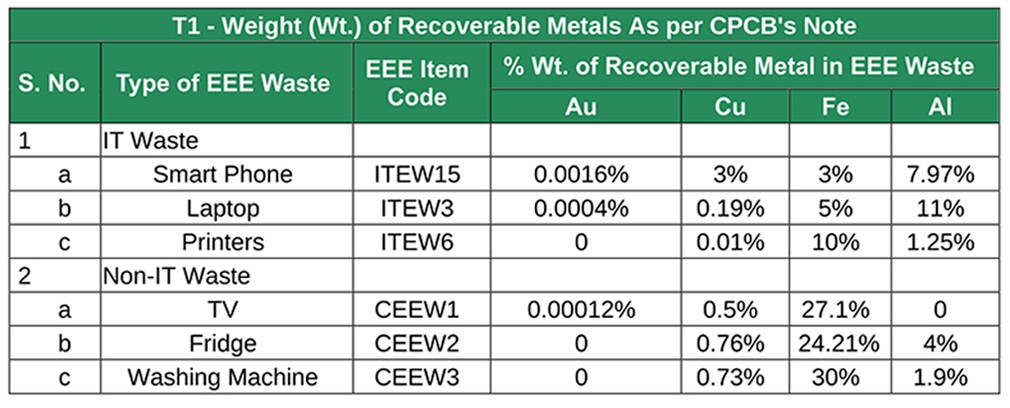

• According to CPCB notification, the % weight of key metals recycled from these 6 products are listed below in Table-1 (T1):

• As per Schedule-III of E-Waste Management Rules (2022), the sales (by weight) made by company ‘ABC’ and its EPR liability for the above mentioned IT and Non-IT products would be as given in table 2 (T2) below;

(To understand the ‘Calculation of EPR Targets for E-Waste generators’ as per the said rules, please refer to section 4 & 5 of our blog post titled “What is EPR & How to Calculate EPR Targets for E-Waste?” at – CLICK HERE )

•The EPR certificates required by company ‘ABC’ for each metal are listed below in table 3 (T3):

• We illustrate below the calculation in table T3 above for item code ITEW15 for FY 2023-24;

✔ EPR liability for Cu = total weight (in tons) ×1000 (kg) × % Wt. of Recoverable Cu given by CPCB = 400×1000×3/100 = 12,000 kg.

✔ EPR liability for Fe = total weight×1000× % Wt. of Recoverable Fe given by CPCB/100 = 400×1000×3/100 = 12,000 kg.

✔ EPR liability for Al = total weight×1000× % Wt. of Recoverable Al given by CPCB/100 = 400×1000×7.97/100 = 31,880 kg.

✔ EPR liability for Au = total weight×1000× % Wt. of Recoverable Au given by CPCB x EPR obligation of gold in FY 2023-24 = 400×1000×0.0016/100×20% = 1.3 kg.

• Note: As per clause(vi) of the said notification, EPR obligation for gold (Au) will be 20% of total gold obligation in the first year of implementation in FY 23-24(1st year) and it will increase by 10% for next year, 15 % for next two years, thereafter by 20% in subsequent two years. (i.e., 30%,45%,60, 80 and 100% for the year 2028-29).

• For other EEE item codes, the EPR obligation will be calculated similarly and the calculated values are given in the table 3 (T3).

References

*For any queries regarding this article/blog email us at : info@gemrecycling.com

Previous Post

Previous Post